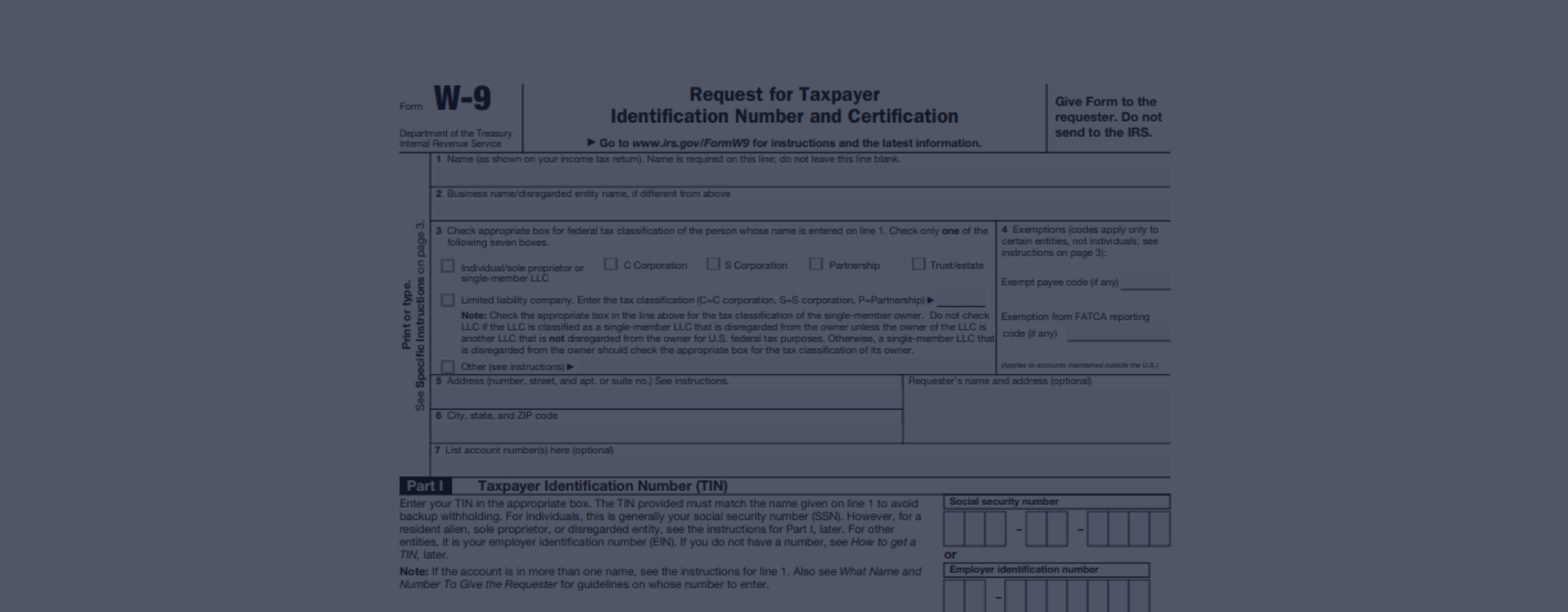

Tax Form W-9: All Relevant Information for 2023

W-9 tax form is a document required by the Internal Revenue Service. If you’re asked to fill one, that means your employer needs to know your Social Security number and other personal data. This info goes to IRS, so the government knows how much money you make annually.

But independent contractors are also compelled to send the IRS form W-9. So, if you’re a wedding photographer, freelance Farsi translator, or SCV product manager — dealing with the form W-9 is unskippable for you.

So, to put it simply, tax form W 9 purpose is to make freelancers and indie contractors accountable to the IRS. Full-time employees don’t file the form personally, as it’s done by default when they get hired.

How to Fill Out W-9 Form: Step-by-Step Instruction

So, your question What is an IRS Form W 9? Has been answered. Again, file it personally if only you’re a freelance worker. Full-time employees shouldn’t do this, as they are provided with another IRS form: W-4.

Filling out the W9 Form is actually quite easy. The blank is straightforward, with every field being self-explanatory. So, to succeed with this mission, follow our Form W-9 instructions! Here’s what you need to do with W9 Form 2023:

- TIN. Provide your Taxpayer’s Individual Number. SSN or EIN can be used.

- Name. Enter your birth certificate name, like Richard J. Hawk.

- Brand. Write in your business name. (It can be either a brand or a pseudonym you’re working under).

- Business type. Select business entity type: LLC, Trust, Corporation S, partnership, etc.

- Optional. Check exemptions.

- Address. Detail your city, state, zip code, and street address.

Also, at your desire, you can name the requester in the fillable form W9. In other words, mention the person who asked you to provide the document. It serves as an extra safety measure: W-9 contains your Social Security number, after all.

But to do all that, you’ll need to download W-9 Form. Luckily, you don’t need to hunt for it around the entire Internet — the W-9 form in PDF is available right here. Totally legit and free!

Possible Dangers of Filing W-9 Form Online

-

![Intruders]() IntrudersIf somebody you don’t really know wants you to file them a or a form or its copy — be extra careful. The W-9 form contains sensitive data, like the SSN and address.

IntrudersIf somebody you don’t really know wants you to file them a or a form or its copy — be extra careful. The W-9 form contains sensitive data, like the SSN and address. -

![Fake Data]() Fake DataProviding fake information in your W-9 form is punishable by a $500 fine. In case it’s done regularly, imprisonment is quite possible.

Fake DataProviding fake information in your W-9 form is punishable by a $500 fine. In case it’s done regularly, imprisonment is quite possible. -

![Casual Mistake]() Casual MistakeAlso, be extra careful when detailing your TIN: an occasional mistake can cause a $50 fine. Besides, each failure is punished separately.

Casual MistakeAlso, be extra careful when detailing your TIN: an occasional mistake can cause a $50 fine. Besides, each failure is punished separately.

Essential Details to Pay Attention on

But there are some nuances as well. First, you’ll need to get tax form W9 downloadable if only your annual revenue from freelance work is at least $600. Besides, sometimes free W-9 tax form is requested to record other income-generating sources: selling real estate, receiving profit from bonds, and so forth. Gambling and the lottery don’t qualify, though.

Additionally, if you’re an independent contractor and you appropriately file the form W-9 online or printable copy by physical mail, you can qualify for more deductions for work-related expenses. For instance, you may support a home office, pay for advertising, etc.

Due Date & Schedules

Both types of W-9 Forms online and printable have no official deadline for filing. You can use the date of January 31 as your compass, though: this is the day by which all 1099-MISC forms must be submitted to the IRS office. We recommend that you file and send yours as soon as you get a job contract. Simply download form W-9 printable from our website and go for it!

Fill OutW-9 Form 2023: Popular Questions

- Is the online W-9 form free to use?Yes, it is a standard form provided by the Internal Revenue Service (IRS) and can be obtained from their website for free. The W-9 form is used to provide a taxpayer identification number (TIN) and certify that the TIN is correct. Typically businesses and individuals fill it out to report payments made to other companies or individuals for services rendered or different types of income.

- Is it possible to print out a PDF version of the W-9 form?Yes, the form is available for download on the IRS website, or you can find it through a quick online search. Once you have downloaded the form, you can print it out on your own printer or take the file to a print shop to have it printed professionally.

- Is the W-9 form valid for use in 2023?Yes, it’s valid. The form is a standard and used by the IRS and is updated periodically to reflect any changes in tax laws or requirements. You can fill out the current form version anytime, even if it is beyond the current tax year.

- Where can I find a printable blank W-9 form to fill out?You can find a blank W-9 form to fill out on the IRS website. The form is available for download in PDF format, and you can print it out or fill it out digitally using a PDF editor. You can also request a blank form from the person or business requesting the form from you.

- Can a W-9 Form be filed by foreign individuals and entities?Foreign individuals and entities may be required to provide a TIN if they receive certain types of income from U.S. sources, such as interest, dividends, rent, or other types of payment. Foreign individuals and entities may also be required to provide a TIN in case they are engaging in a trade or business in the U.S. In these cases, the foreign individual or entity can use a W-9 form to provide their TIN and certify its accuracy. However, it is important to note that foreign individuals and entities may be subject to different tax rules and requirements. It may be necessary to consult with a tax professional or the IRS for guidance on these issues.

The Latest News

Interesting Facts About the W-9 Form The W-9 form is a tax document that is used by individuals and businesses in the United States to provide their taxpayer identification number (TIN) to a requesting party. While it may not be the most exciting topic, there are still some interesting facts about the W-9 form that you may not know. He...

Interesting Facts About the W-9 Form The W-9 form is a tax document that is used by individuals and businesses in the United States to provide their taxpayer identification number (TIN) to a requesting party. While it may not be the most exciting topic, there are still some interesting facts about the W-9 form that you may not know. He... - 27 December, 2022

- How to Get Printable Version of Form W-9? A W-9 form is a tax document used in the United States to provide a taxpayer identification number (TIN) to a requesting party, typically an employer or payer. The requesting party will use the TIN to report income or other tax-related information to the Internal Revenue Service (IRS). To get a pri...

- 23 December, 2022

- Forms Related to W-9 The W-9 form is a tax document used in the United States to provide a taxpayer identification number (TIN) to a requesting party, typically an employer or payer. The requesting party will use the TIN to report income or other tax-related information to the Internal Revenue Service (IRS). There are...

- 22 December, 2022

Get the Fillable W-9 Form for Online Filing

Get FormPlease Note

This website (form-w9-2023.net) is not an official representative, creator or developer of this application, game, or product. All the copyrighted materials belong to their respective owners. All the content on this website is used for educational and informative purposes only.